Forex Write for Us

Forex Write for Us – Vigorblog is looking for experienced forex and binary options traders to write articles on various topics. Share your knowledge with other traders of all skill levels and receive a backlink with each article while building great web visibility.

We will consider guest post offers related to Health, Diet, Skin, Products, Beauty, and Technology. If you would like to contribute an article, please send an email to contact@vigorblog.com

Why Vigorblog?

By contributing toVigorblog, you will benefit from Vigorblog audience and network reputation, strengthening your brand name.

Contributors will receive a dedicated profile page displaying all of the articles they produced for Vigorblog, allowing them to build strong branding either as an individual or under the contributor’s brand.

Under their profile page, contributors can highlight their expertise, company brand, published content, and more.

How to Update Your Articles?

To Write for Us, you can email us at contact@vigorblog.com

What is Forex?

Foreign exchange, or forex, is the term used to describe the international market where participants trade various currencies. It is a decentralized market where people, businesses, banks, and governments can buy and sell currencies to promote global trade and investment.

How Does Forex Work?

Banks, brokers, and electronic communication networks (ECNs) are just a few financial entities that make up the network through which forex is run. As the market follows the sun worldwide, trading happens five days a week, 24 hours a day, in several time zones. Currency pairs are created by quoting the value of one currency against another. These currency pairings’ exchange rates alter according to supply and demand dynamics.

How is Forex Traded?

Trading forex entails making predictions about the movements of currency pairings. By purchasing a currency pair at a lower price and selling it at a higher price or by selling it at a higher price and repurchasing it at a lower price, traders hope to make money. Forex can trade using a variety of platforms, such as trading software, online brokers, and tools for charting and analyzing in real time.

Major Participants in Forex

Commercial banks: Take on the role of market makers by supplying liquidity and carrying out customer orders.

Institutional investors: Hedge funds, pension funds, and investment companies carry out significant foreign exchange transactions.

Retail traders: Individual traders like you who use brokers to gain access to the forex market.

Key Factors Influencing Forex Markets

Economic indicators: Currency values influence by economic factors such as GDP, employment rates, inflation, and central bank policy.

Geopolitical events: Political stability, trade agreements, and geopolitical conflicts can all impact the FX markets.

Market sentiment: Changes in currency prices influence by trader emotions, news, and expectations.

Risks of Forex Trading

Volatility: Forex prices can fluctuate significantly and quickly, which could result in profit or loss.

Leverage: Because traders can take control of significant holdings with comparatively little capital, margin trading magnifies wins and losses.

Market Risks: Trades may be affected by market risks such as slippage, liquidity gaps, and execution concerns.

Economic and Political Risks: Economic and political risks can result in abrupt fluctuations in currency value due to unanticipated economic shocks, policy shifts, or geopolitical crises.

Risk Management in Forex Trading

- Placing stop-loss orders to cut back on possible losses.

- Applying appropriate position-sizing and risk-reward ratios.

- Using a variety of trading methods rather than depending primarily on one.

- Monitor and analyze market circumstances and keep up with pertinent news developments.

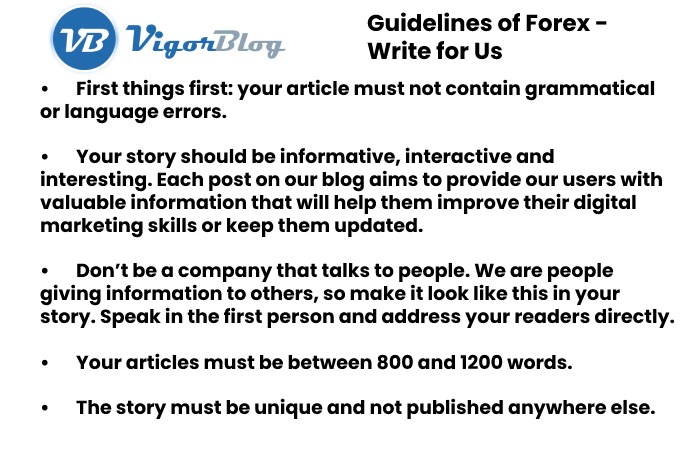

Guidelines of the Article – Forex Write for Us

You can send your article to contact@vigorblog.com